上周全球主要股市均上涨。我们跟踪的全球16个主要国家和地区指数都上涨。其中中国台湾、上证指数和深证指数涨幅领先,恒生指数排在涨幅第六位。A股申万28个行业中25个上涨,抱团股涨幅领先,而农林牧渔、公用事业和钢铁三个行业下跌。港股恒生12个综合行业中9个行业上涨,3个行业下跌,其中金融、非必需消费和综合业涨幅居前,而电信、能源和科技行业下跌。北上资金净流入468.1亿人民币,为年初以来周度净流入最大,南下资金净流入76.9亿港币,较前一周下降62%。

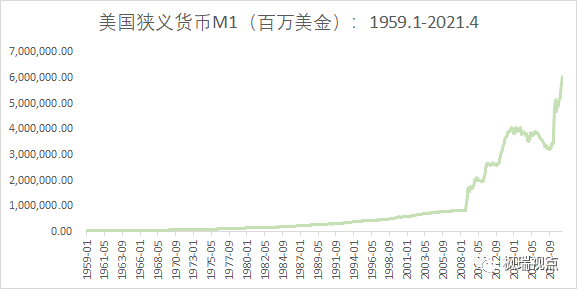

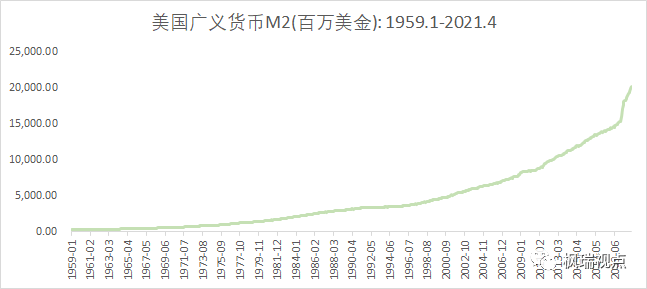

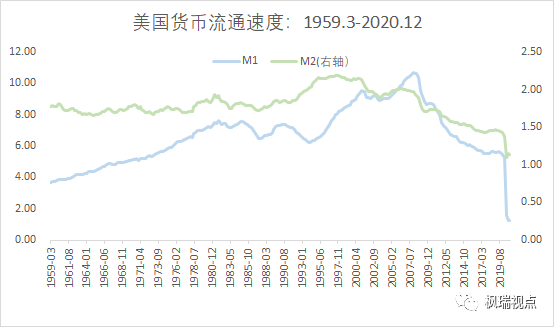

新冠危机和08年金融危机美联储放水的效果有很大不同。2020年3月疫情发生后,美国狭义货币M1从2020年2月底的3.4万亿美金(下同)上升到2021年4月底的6万亿,11个月间上升75%(图一);同期M2(即银行存款加上现金)从1.5万亿上涨到2万亿,上涨32%(图二)。对照2008年8月底,基础货币接近8500亿,到2009年9月上涨到1.8万亿,上涨121%;而同期广义货币M2仅上涨了8.4%。本轮危机中M2增速超过金融危机期间的增速,主要是因为本次危机后美联储将资金直接发放到消费者手中。而2008年美联储是将资金发给银行,并且对存在银行的超额储备金支付利息,导致这些钱一直存在银行账户上,没有产生货币派生,所以M2增速低于基础货币增速。08年以来虽然美国放水不少,但通胀一直保持在较低水平,这是一个原因。新冠疫情发生后,美国货币流通速度直线下降,M1的货币流通速度从2020年3月底的5.25下降到2020年底的1.22(图三),而同期M2 的货币流通速度从1.38下降到1.13,M1和M2流通速度的降幅分别为77%和18%。而2008年金融危机期间,M1和M2的流通速度分别从2008年9月份的10.37和1.9下降到2009年9月份的8.67和1.7,分别下降了16.8%和8.4%。本次危机货币流通速度大幅下降因为疫情不确定性导致老百姓手握巨额现金而不敢花钱。随着疫情缓解,美国消费者加大支出,低利率、低通胀和低增长的时代可能即将过去。

图一:美国狭义货币

数据来源:WIND

图二:美国广义货币M2

数据来源:WIND

图三:M1和M2的流通速度

数据来源:WIND

美股上涨。本周五将发布的非农就业报告会影响联储行动。就业状况如果改善,美联储拖延宽松的货币政策就没有有力的借口。

Last week (the same below) all of the major indexes in the world rose. Taiwan China, Shanghai Composite Index and Shenzhen Composite Index rose the most. Hang Seng Index was ranked at the sixth in terms of rise range. 25 out of 28 sectors rose in A-share with group-holding stocks rising the most while farming and fishery, utilities and iron and steel falling. 9 out of 12 sectors in HK market rose with financials, discretionary consumption and conglomerates rising the most. Telecom, energy and technology sector fell. North-bound capital net inflow was RMB 468.1 billion, the highest weekly net inflow year-to-date. South-bound capital saw net inflow of HK$7.69 billion, down 62% from the previous week.

The stimulus effects are different between pandemic crisis and 2008 global financial crisis. In 2008 Fed injected liquidity to financial institutions and paid interest for excess deposit reserve. This caused that financial institutions kept big amount of money on their accounts and the economy got little money. This explains the low inflation since 2008. This time the US government transferred big money to consumers. Hence, there was more money in economy this time than after 2008 financial crisis. Another difference between these two crises is that velocity of M1 and M2 fell sharply in this pandemic crisis compared with 2008 financial crisis. The reason behind is that while consumers have big money on hands the uncertainties associated with the pandemic forced them to save money rather than to spend. But as the pandemic hasbeen well under controlled with vaccination rollout going smoothly the uncertainties would disappear gradually. American consumers will spend money and drive up inflation as well as economic growth sooner or later.

Dow and SP 500 rose lastFriday. The non-farm payroll in April to be released oncoming Friday would have a big impact on Fed’s decision of tapering. If the non-farm payroll comes in above expectation, the Fed would have no good excuse to delay in taking back liquidity.

声明:本市场点评由北京枫瑞资产管理有限公司(以下简称“枫瑞资产”)“枫瑞视点”微信公众号提供和拥有版权,授权上海海狮资产管理有限公司转载。在任何情况下文中信息或所表述的意见不构成对任何人的投资建议,枫瑞资产不对任何人因使用本文中的内容所引发的损失负任何责任。未经枫瑞资产书面授权,本文中的内容均不得以任何侵犯枫瑞资产版权的方式使用和转载。市场有风险,投资需谨慎。

免费咨询电话:0757-2833-3269 或 131-0659-0746

公司名称:上海海狮资产管理有限公司 HESS Capital, LLC

公司地址:广东省佛山市顺德区天虹路46号信保广场南塔808

Copyright 2014-2020 上海海狮资产管理有限公司版权所有

沪ICP备2020029404号-1